All About Schedule A Form 1040 or 1040-SR: Itemized Deductions

California excludes U.S. social security benefits or equivalent Tier 1 railroad retirement benefits from taxable income. Enter in column B the amount of taxable U.S. social security benefits or equivalent Tier 1 railroad retirement benefits shown in column A, line 6(b). In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2015. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level.

Please keep in mind that filling out your tax forms by hand may result in unintended errors (which can lead to delayed tax refunds and even rejections) and is generally a more lengthy process. You can find both Schedule A and Form https://kelleysbookkeeping.com/the-difference-between-margin-and-markup/ 1040 in the pdfFiller online library and complete the forms conveniently using our online PDF editor. This way, you will save precious time and avoid any possible errors before they cause any confusion in your tax filing.

Who needs to file a Schedule A tax form

If the amount was excluded for federal purposes, make an adjustment on line 8z, column C. However, the California basis of your other assets may differ from your federal basis due to differences between California and federal law. Therefore, you may have to adjust the amount of other gains or losses. Enter on line 19a the same amount entered on your federal Schedule 1 (Form 1040), line 19a.

Schedule A is for itemizers — people who opt to pick and choose from the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction at tax time. Claim of right – If you had to repay an amount that you included in your income in an earlier year, because at the time you thought you had an unrestricted right to it, you may be able to deduct the amount repaid from your income for the year in which you repaid it. If the amount you repaid is less than $3,000, the deduction is subject to the 2 percent AGI limit for California purposes. If you are deducting the repayment for California, enter the allowable deduction on line 21.

What Can Be Claimed on Schedule A?

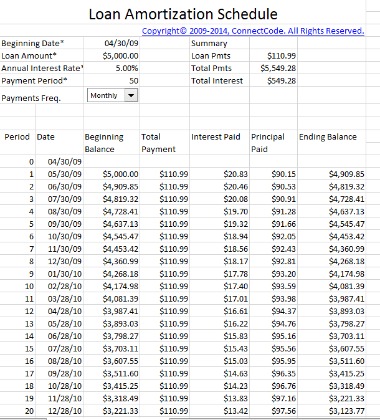

Adjustments to federal income or loss you reported in column A generally are necessary because of the difference between California and federal law relating to depreciation methods, special credits, and accelerated write-offs. As a result, the recovery period or basis used to figure California depreciation may be different from the recovery period or amount used for federal. If you received alimony not included in your federal income, enter the alimony received in column C. Any U.S. taxpayer can file a Schedule A Form and claim itemized deductions as an alternative to taking the standard deduction, choosing the option that provides greater tax savings. Under federal law, the deduction for miscellaneous itemized deductions subject to the 2 percent floor is suspended. If you claimed a credit for the repayment on your federal tax return and are deducting the repayment for California, enter the allowable deduction on line 16, column C.

- As a result, the recovery period or basis used to figure California depreciation may be different from the amount used for federal purposes.

- Federal law allows a deduction for personal casualty and theft loss incurred in a federally declared disaster.

- If you have a California disaster loss deduction and there is income in the current taxable year, enter the total amount from your 2022 form FTB 3805V, Part III, line 2 and/or line 3, column (f), as a positive number in column B.

- Remember to use the California tax rate in your computations.

For further guidance, see federal Publication 525. For North Carolina tax purposes, a taxpayer is allowed a deduction for the repayment to the extent the repayment is not deducted in arriving at the taxpayer’s adjusted gross income in the current taxable year. If the repayment is more than $3,000, the deduction is the amount of the repayment. Schedule A Form Itemized Deductions Guide If the repayment is $3,000 or less, the deduction is the amount of repayment less 2% of adjusted gross income. For information on how to compute the claim of right deduction, see “Repayment of Claim of Right Income” and “Repayment of Claim of Right Worksheet” located in the North Carolina Individual Income Tax Instructions.

Expert does your taxes

California law does not conform to this expansion of PPP eligibility. If you met the PPP eligibility requirements and excluded the amount from gross income for federal purposes, enter the excluded amount on line 3, column C. California taxes long and short term capital gains as regular income. No special rate for long term capital gains exists. However, the California basis of the assets listed (within this line instructions) may be different from the federal basis due to differences between California and federal laws. If there are differences, use Schedule D (540), California Capital Gain or Loss Adjustment, to calculate the amount to enter on line 7.

If you need bookkeeping support for taking the itemized deduction, Bench can help. Your Bench bookkeeper keeps your financial reports up-to-date, giving you access to essential and accurate information on your business’s financial health. Then, when tax season rolls around, a CPA or tax professional can use your Bench-generated financial reports to get your taxes filed—and advise you on which deduction to take.

Who Can File Schedule A?

Enter on line 19b the social security number (SSN) or individual taxpayer identification number (ITIN) and last name of the person to whom you paid alimony. If you’re on the fence about whether itemizing is worth it for you and want a quick assessment, see if you fall into one of the following categories. These are indicators that your itemized deductions will be higher than the average person.

IRS issues guidance on state tax payments to help taxpayers … – IRS

IRS issues guidance on state tax payments to help taxpayers ….

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

The CAA, 2021, allows deductions for eligible expenses paid for with covered loan amounts. California law conforms to this federal provision, with modifications. For California purposes, these deductions generally do not apply to an ineligible entity.

More In Forms and Instructions

For spouses filing as married filing separately or married filing jointly, the total home mortgage interest and real estate taxes claimed by both spouses combined may not exceed $20,000. For spouses filing as married filing separately with a joint obligation for home mortgage interest and real estate taxes, the deduction for these items is allowable to the spouse who actually paid them. If the amount of the home mortgage interest and real estate taxes paid by both spouses exceeds $20,000, these deductions must be prorated based on the percentage paid by each spouse. For joint obligations paid from joint accounts, the proration is based on the income reported by each spouse for that taxable year.

- Middle Class Tax Refund – The California Middle Class Tax Refund is a one-time payment issued to provide relief to qualified recipients.

- Keep in mind that the total deduction for this entire section can’t exceed $10,000 (as explained in Lines 5d-e).

- Other loan forgiveness – Under federal law, the CAA, 2021, allows deductions for eligible expenses paid for with covered loan amounts.

- Combat zone extended to Egypt’s Sinai Peninsula – Federal law extended combat zone tax benefits to the Sinai Peninsula of Egypt.

- For more information, see R&TC Section and Schedule CA (540) specific line instructions in Part I, Section B, line 8z.